Black Friday is coming up. The annual shopping mania will undoubtedly cause long lines at the checkout again. Yet this year - due to inflation and energy crisis - some people are spending more consciously. How is your money flowing this Friday?

Of course, all those sky-high discounts are hard to resist and sometimes it's actually convenient for the wallet to wait until Black Friday to make a big purchase. Yet you quickly spend a lot of money on things you do not really need. Not good for your bank account, but also not good for the environment.

Biggest spending event of the year

Black Friday is originally an American holiday and falls on the Friday after Thanksgiving. The day is seen as the starting point for Christmas shopping. Although Thanksgiving is hardly ever celebrated in Europe, Black Friday is here to stay. The phenomenon is now also the biggest spending event of the year in the Netherlands and the rest of the EU. According to Ypuls, three out of four young Europeans plan to store with Black Friday discounts. Yet they probably have less to spend this year.

Also popular is Cyber Monday, the first Monday after Black Friday, when digital shopping baskets are filled. Yet the discounts often do not stop at these two days. Some stores have deals all week or even all month.

Want to take advantage of Black Friday and Cyber Monday without ending up with a house full of bargains and gadgets? Then only purchase items at a steep discount for which you have already saved up in advance. If you celebrate Christmas with the whole family, it is also convenient to score some deals. Make a list before your shopping day; this will make it easier to resist temptations.

Green Friday

Are you looking for a green alternative to Black Friday? Then participate in Green Friday. The nonprofit organization Trees for All is making a statement against the shopping frenzy by planting trees.

Whatever you do this Friday: at least leave the things you don't need or put them on your list for next year. Another budget tip for when you have a wish list: make a savings jar for the things you want to purchase. Divide the cost by 12 and set aside the result of that calculation each month in the savings jar. Will you not need or want the items next year? Then you have a nice buffer for your savings account!

Saving first and spending later is a great thing to practise.

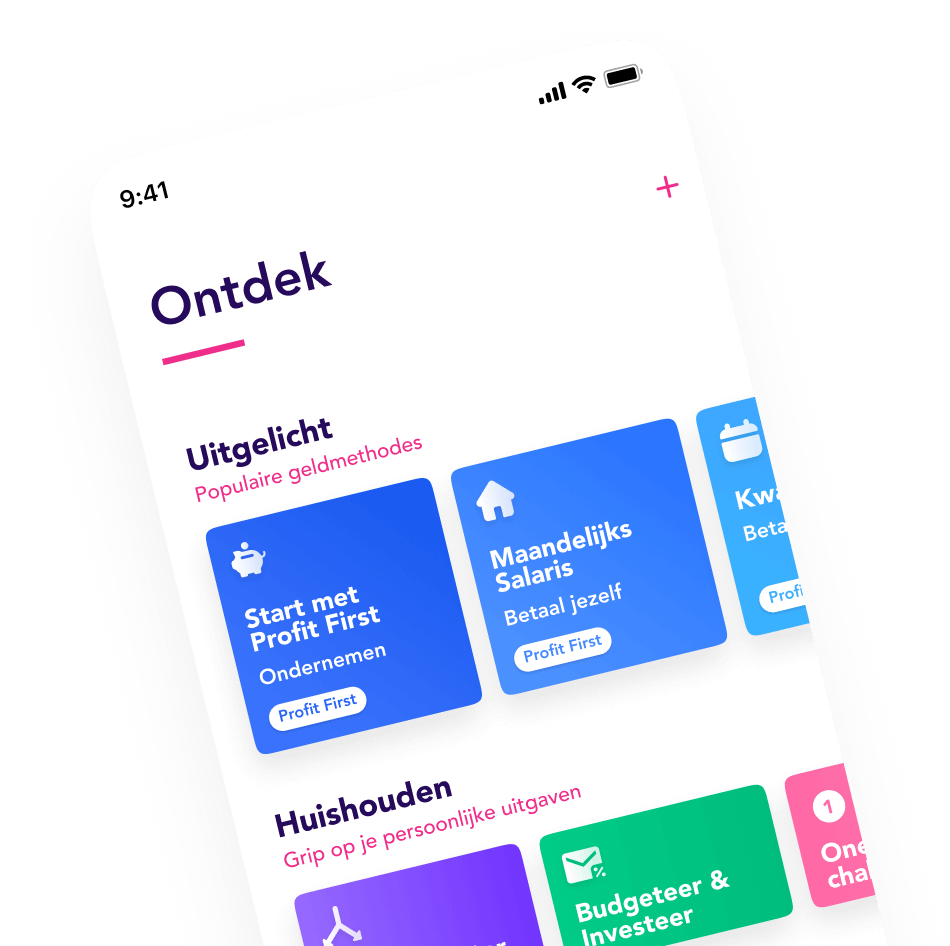

With the Flow app you can easily automate your savings goals and spending plan. That way you no longer have to think about the finances of your purchases for next year. This is how you Flow your money consciously! Download the app