Recently we introduced Flow Contacts. This allows Flow to automatically transfer money to other bank accounts and services as long as they have an IBAN.

Bank accounts that you can't yet connect in the Flow app, you can now add as Flow Contacts. Think of your savings account at Rabobank or ING or bank accounts like N26, Monzo and Revolut.

And what about savings?

It is becoming more common to divide your savings account into jars. These are separate jars without an IBAN, where you can create categories within your own savings account. With these jars, you cannot make payments, so you will first have to transfer money manually to your checking account. The jars of bunq and Knab can be linked in Flow. Other jars, unfortunately, cannot be added in Flow because they do not have a seperate IBAN and the bank has not made them available.

Which accounts can you link in your Flow Contacts?

We have made a list full of examples for you:

- Savings accounts with an IBAN (International Bank Account Number)

- N26 checking account

- Monzo checking account

- Revolut checking account

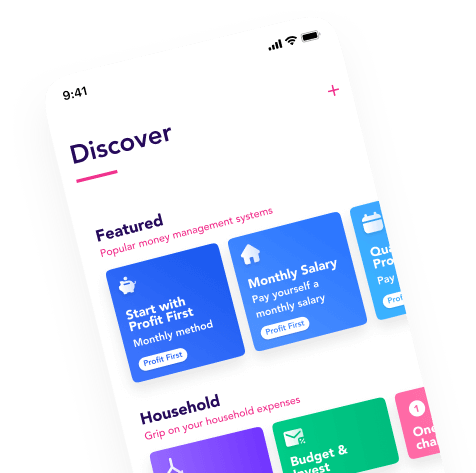

Build these flows with an additional account in Flow Contacts

You can already set up smart Flows with two bank accounts to make your money matters easier. For example, with two bank accounts you can use:

- VAT Buffer: automatically flow 21% VAT to your second bank account or savings account when your invoice payment comes in.

- Salary Sweeper: when there is money left in your account at the end of the month, you automatically flow it to your savings account. That's easy saving!

- One cent challenge: Do you like a challenge? Save 1 cent on day 1, and 2 cents on day 2. How long will you keep it up?

This is how to add an account as a Flow Contact

You can set this up in the Flow app by adding the savings account or unconnected bank account as a contact:

- Go to the Profile tab

- Click on 'Manage contacts'

- Click on the + to add a contact

- Enter the name of the account number (IBAN) (the official name as known to the bank)

- Enter the name you want to give to the contact (for example: 'Rabo savings account')

- Fill in the IBAN of the bank account or savings account. Make sure the IBAN is correct. It is not automatically checked, as your bank app does.

- Finally, choose the color of your avatar.

- If you have more savings accounts or unconnected checking accounts, add them in the same way.

This is how to create a flow with your savings account or bank account

Make sure you've added your savings accounts and bank accounts as Flow Contacts. Next, go to the Flow Builder.

Then:

- Add a trigger. When do you want to transfer money? Weekly, every other week or monthly? Do you choose to transfer it monthly? Decide if you want to do it on a specific date, at the beginning or the last day of each month - or maybe you prefer to do it when your salary comes in.

- Choose the account from which the extra savings or checking account will be paid.

- Choose the action. You can transfer an amount, a percentage or 'anything left over'. Payment actions such as 'fill amount up to € 300,-’ unfortunately do not work because Flow has no insight into the balance of your Flow Contacts.

- As the destination of your money, choose the desired account from Flow Contacts.

- Save the Flow and you're done!

Happy automating!