December is known to be an expensive month. More food, gifts and social fun lead to spending more and saving less. You wouldn’t be the first who finds the bank account nearly empty halfway through the month. The obvious solution: take some money from the savings account to make the end of the month. You’ll have a little less savings then, but you made it, right?

If you are looking for more insight into your finances, we might have a better solution for you. In this article, we’ll explain how automation can help you solve this problem for once and for all.

Organize your finances with the jar system

We strongly believe the jar system can help you to get true overview in your finances. I mean, how great is it to know whether you still have enough money for that cool jacket, or how tight your budget has become after another raise in energy prices, which you might need to adjust. Whether it’s fun spending or higher costs, it’s good to be able to see where you are at.

When you have one bank account to pay from, it’s impossible to have overview. Even Excel sheets and budgets are great and all, but because it’s so much work to keep track of your budgets, it won’t help much. It’s a first step, but you’ll need overview as well. Preferably, when you need the information the most. When you are in a store, for example, deciding on what to buy.

So, how does that work?

What if you have jars, like our grandparents used to have. There’s cash for groceries, cash for clothing and cash for gas. To know whether your budget is doing well, you look into the jar, and you can tell straight away. If the money is gone, it’s gone.

And how do you do that in the 21st century?

Of course, we don’t work with actual cash and jars any more because it’s a hassle. We can create the jar system digitally. Let’s take the December expenses.

- Calculate how much extra money you’ll spend this month.

- Divide the money through 12.

- Create a savings jar at your bank

- Set aside that number each month

- To make it easier: make it an automatic payment

At the end of next year, you have saved up money, so you can spend extra in December. So, when December kicks around the corner, you either pay the extra’s from that savings jar, or you put the extra money on your bank account, and you’re good to go.

Isn’t that the same as taking it from your savings account?

It seems that way, but actually: no. You don’t count this money as ‘real’ savings, as you are preparing it for a particular purpose. When December starts, you’ll feel like you have a plan. You don’t have to painfully ‘eat’ from your savings account. You know what you’re doing.

Furthermore, you feel in control, and you have the overview over your December spendings. Because you calculated a budget, it’s doable to stay within budget, too.

And other budgets?

You can do the same for other budgets. For example:

- groceries

- pocket money

- kids

- sports

- taxes

- holiday

This way, that new jacket or new running shoes will be paid from the appropriate jar. You’ll need a second to tell whether you can buy running shoes or a jacket, while checking your pocket money jar. You will never spend grocery money on things that are nice to have. As that is a different jar, you won’t touch it, besides for paying groceries.

Automate it all!

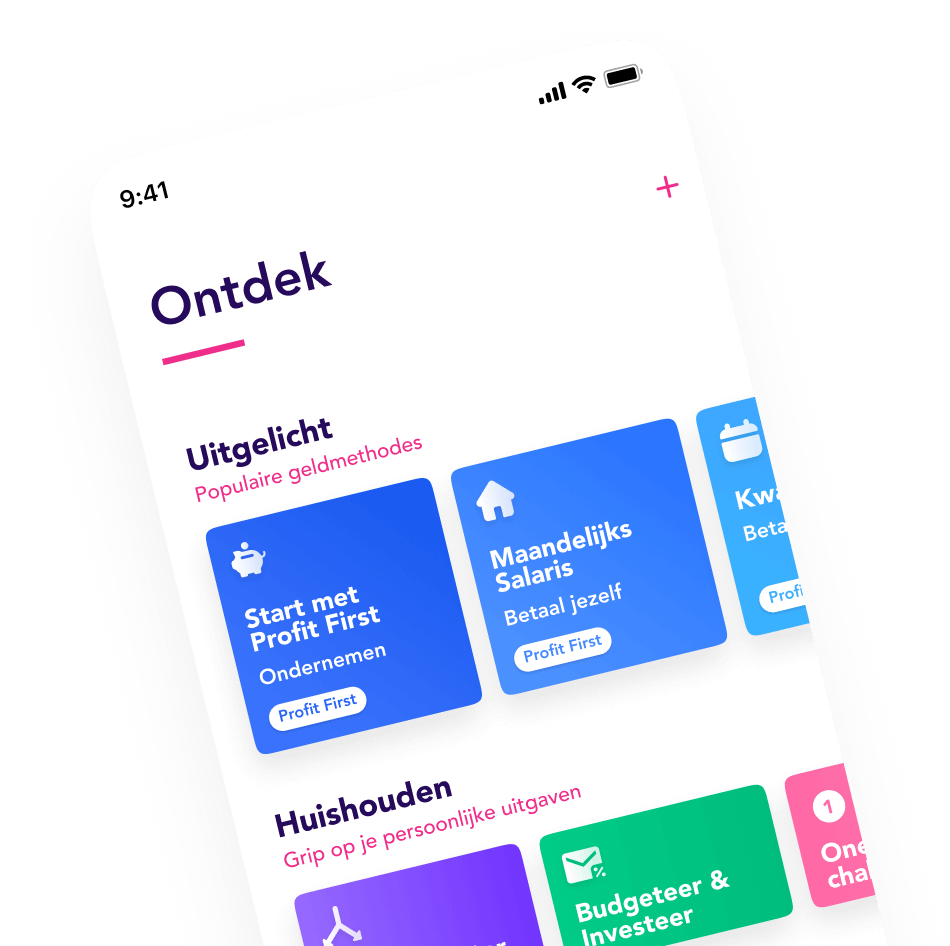

As Flow, we are very passionate about automating filling all your jars. Why? Because the jar system works so well, and automation makes it even easier. And did you know: when it is easy to do, it encourages you to stick to your plan?

So at the end of the day, you’ll be spending more mindfully and saving more. Once you see the results, you’ll be motivated to do even better. Maybe you’ll even start to enjoy doing your finances.

With the Flow app, you can automatically distribute your money over your bank accounts, as long as it’s an IBAN. The two banks bunq and Knab offer several accounts within one subscription. This means you can have several budgets and pay from the accounts.

Unfortunately, the traditional big banks are still catching up to this new trend. There you’ll have one bank account and an extra bank account costs double the money, usually.

The best solution if you have an ‘old’ bank

If you fully want to enjoy the jar system, but don’t feel like going through the hassle of changing banks, we have a solution for that too. Your fixed costs could still be paid from your current bank account. Just open a new bank account at Knab or bunq and make all the budgets and jars you want. This is how to do it:

- Open a bank account at Knab or bunq.

- Create jars and budgets.

- Calculate your fixed costs.

- When your salary comes in, leave the amount of your fixed costs on your current bank account.

- Forward everything over to bunq or Knab and distribute your money according to your rules.

- Easy does it!

Happy automating.