Kim de Jong is founder of House of Tax, with which she removes the stress and anxiety surrounding taxes and administration for entrepreneurs. Through workshops, consults and presentations, she helps them create a solid financial plan. She used to be bad at saving, but now invests her money in all kinds of ways and to realize her dream: to be completely financially free.

The fun part about numbers

"I've always been interested in making money. I started peeling bulbs at 11 and in my teens I taught dance. I wasn't necessarily good at saving; everything I earned I quickly spent back on fun things. When a knee injury forced me to quit dance school, I went to work at Postbank business, now ING, when I was 20. I received a training programme there, after which I could start work as a financial consultant. I did that in all sorts of places, both at home and abroad, in financial departments. At TomTom I was allowed to describe financial processes and how they are linked to marketing and sales. For me, that was the point at which 'I just happened to roll into the financial world' changed to 'hey, I really like doing this'. I'm not particularly fond of numbers, but I like the translation of them. What do the numbers say? What does it mean?"

Funeral director or tax consultant

"In the corporate world, it's very difficult to change things. I wanted to be able to make decisions faster and have more freedom, including being able to travel. The urge for freedom to set my own hours became even stronger when my son was born. He was going to daycare forty hours a week, and all I was doing was rushing and scurrying from home to the office and vice versa. This was not the life I wanted. Starting for myself was the solution. I asked myself: what is there to make money in? And what can I do? Then I figured out that there are two things certain in life: death and taxes. Either I become a funeral director or a tax consultant. It was as simple as that. Because of my knowledge and expertise, logically, I became a tax consultant."

Money problems

Because I knew that money could be made in the financial world, and that I could easily find work elsewhere if necessary, I was very relaxed when I started my own business. When I lived in Australia years before that, I sometimes had real money problems. I'd have less than a hundred dollars in my bank account, no place to sleep and no job. That made me very creative. I walked into the first hostel I saw and asked if I could help out a few hours a week in exchange for a room. I could. I asked $5 per person for people who wanted to eat together. Then I did some smart shopping and cooking, so we had enough food, and I didn't have to put anything in. That's how I figured out: if money needs to be made, I can do it."

House of Tax

"I remember that someone had received a huge fine from the Tax Office because she had followed financial advice from someone on Facebook. At this, I decided together with the tax consultant with whom I work: that's really not acceptable, we have to help entrepreneurs who know little about money to prevent this kind of situation. And so in 2013 we started House of Tax, with workshops and webinars. That was and is so cool, because as a bookkeeper you get to see what happened afterwards, but in our company we get to speak to people beforehand. You hear their stories and can give tips that will help them save time or money. Often people think it is very difficult to have your administration in order, but we show them right away that it is not. We make it fun, work towards the 'hard tax rules' in small steps and first make sure that someone's business is healthy. This gives people peace of mind, after which we create a financial plan and they can start doing what they started out to do in business."

Green, orange and red

"Many entrepreneurs work themselves to death, putting in 100 hours a week. That's fine for a few months, but it shouldn't last too long. Because nine out of ten times people start a business to have more freedom. But if all you do is work, when are you going to enjoy that freedom? My tip to entrepreneurs, but actually to anyone who wants to be smarter with their money, is: make it transparent. As an entrepreneur, make sure you know what activity is giving you what. Is that money, prospect or time? If you know that, you can really make your business a success. And for the non-entrepreneurs, grab your bank statements from the past three months and take out a green, orange and red marker. Mark everything that is necessary, like rent and your utility bill, green. Everything you do not really need, such as a gym or Netflix subscription, you color orange, and red becomes everything that is completely unnecessary, such as double travel insurance or a subscription that you never use. This way you can quickly see where your money goes, and where you leave money."

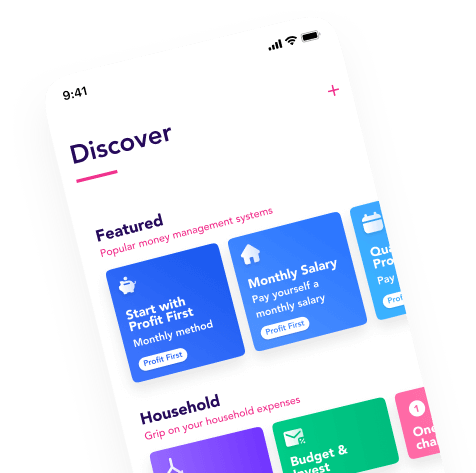

Flow Your Money

"Flow is a very nice follow-up step to the exercise with the three pens. By dividing your money over jars, you force yourself to work with budgets. Because how much are you willing or able to spend on something? I really like Flow because it automates a lot of things, so you keep an overview. And, I have an account where I always want to have a certain maximum amount, because that's exactly the money for two months of fixed costs. In Flow, you can set up a jar so that it is topped up to the amount that I have in mind, and anything above that goes into my investment account. That's exactly what I was looking for."

Investing child support

"I'm someone who likes to make money work for me. Because if you have money, you can make even more money with it, both actively and passively. You used to get interest on your savings account, and nowadays you can get interest in a similar way if you tie up your cryptos for a certain time. I also invest in dividend stocks, index funds, and real estate. I think it's important not to put all my eggs in one basket, but to spread my money around. It gives me peace of mind. My eleven-year-old son is also starting to take an interest in investing. From his child allowance he can buy shares, together with me. He has bought a share of Roblox, and is also in Disney. I think it's very educational for him, and try to instil in him that this is really something for the long term."

Money dream

"My boyfriend and I want to live completely financially free in the longer term. Around 2045 we want to be able to retire. We think it would be great to go from cruise ship to cruise ship and see so much of the world, with the comfort of a good bed, restaurant, entertainment and doctors on board. In addition, we then want to buy a small apartment in Spain where we can stay in between trips. I am very focused on that big money dream. The first step is that we want to cover our fixed costs entirely from passive income. So the mortgage, insurance, gas/water/electricity and municipal taxes. At the moment we get 1000 euros per year from passive income, and if all goes well in 2025 we will be able to pay all our fixed costs from that. I think that gives you a lot of peace of mind, and then you really work for the nice things in life. To buy clothes, to go to restaurants or to go on vacation."

Passive income

"I get passive income from dividends, crypto earnings that I get when I lock in my cryptos for a period of time, and from investing in mortgages. It works like this: entrepreneurs sometimes want to buy a building and convert it into apartments. They don't get the mortgage from the bank, but from investors like me. As an investor, you give them a lump sum of money - you can do that from as little as 250 euros - and every month you get an amount deposited into your account. So you put in money once, and then reap the benefits. I have other tricks that make me money: I have a cryptocredit card, where you get some crypto back when you spend money. I then put that in a fixed amount, and I get interest on that. I invest that interest again, which creates a kind of snowball effect. I also use a web browser, and in return I receive points, which can be converted into crypto coins. I love these kinds of tricks. You have to figure it out and set it up properly, but after that it brings you both convenience and money. It's actually just like Flow. You have to take the time, but afterwards it's worth all the effort."