Your retirement. It still seems so far away. You'd like to make a plan for it, but you'll do that some other time, right? According to Nibud, 40% of 35-55-year-olds have no idea what their retirement will look like. 1 in 3 people aged 45-65 would like to put money aside for retirement, but do not do so due to lack of money.

When people pass the age of 55, they start to think about retirement. This is when it is getting closer and we want to know where we stand and what amount we can count on when we retire.

You may be reading the reports, pensions are steadily deteriorating in terms of purchasing power. And you're staying positive: it will probably work out by then. Yet there is a shift taking place from "it will be fine" to "I'm going to take care of it myself".

Take matters into your own hands

By taking matters into your own hands, you can prevent having less later than you had hoped. And the longer it takes to retire, the longer you have to put a good, valid plan in place, so you can be sure you'll have enough coming in at your old age.

Although we have a young team (average age 28), saving for a good pension is something we take very seriously in Team Flow. Everyone in their own way, but with one common denominator: we build up a pension jar via multiple channels. At least two.

Often these are the following:

- Paying off the house

- Index investing

- Self-employed pension fund

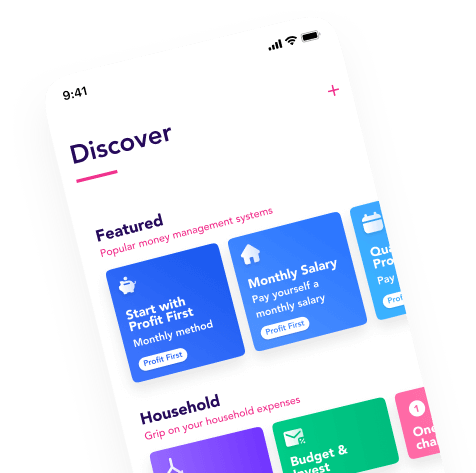

With the Flow app, we make it extra easy to do this. We automate a fixed amount of money to these purposes. Pay off your mortgage (early), invest automatically in an index fund or deposit into your pension fund every month. When our income increases, we keep our salary and reserve more money to these pension pots.

After all, those who work hard also want to retire well (without worries) later on!