By 2021, over 250,000 new entrepreneurs have started. The number of start-ups is high because more and more people are going freelance, but the SME sector is also growing. Yet nearly 133,000 entrepreneurs also quit last year.

Why such a high failure rate? A few reasons may include:

- Poor business planning

- Lack of financial discipline of the entrepreneur

- Poor cashflow management

- A faulty business model

As many as 50% of reasons for a business failure are related to finances. To run a business successfully, an entrepreneur needs to understand the nitty-gritty of cash flow management and develop an appropriate financial discipline.

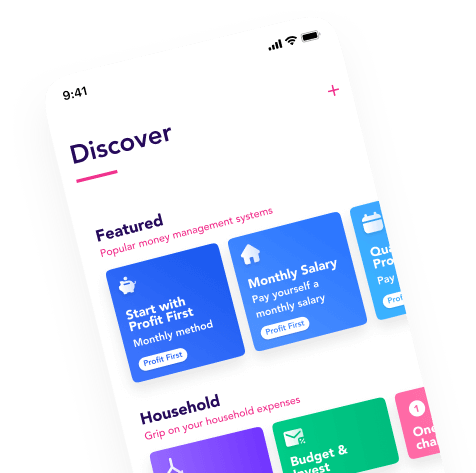

In this guide, we’ll review the top five finance books and provide insights into how they help entrepreneurs develop a healthy money management attitude. Here is the list of the five books that help you, as an entrepreneur, become financially smart:

- Profit First: Transform Your Business from a Cash-Eating Monster to a Money-Making Machine

- The Richest Man in Babylon

- The Lean Startup

- The Millionaire Next Door: The Surprising Secrets of America's Wealthy

- The Intelligent Investor: The Definitive Book on Value Investing.

Profit First: Transform Your Business from a Cash-Eating Monster to a Money-Making Machine

Written by a serial entrepreneur, Mike Michalowicz, this book transforms your attitude and approach towards accounting.

The traditional formula for profit is: Profit = Sales – Expenses

According to this formula, the profit is the money that remains with the organization after it accommodates expenses. If expenses exceed sales, the organization runs into losses.

Mike ditches this traditional formula to create a Profit First framework that emphasizes taking the profit first and apportioning only what remains for expenses.

The formula for Profit First is: Sales - Profit = Expenses

This approach helps entrepreneurs cut down unnecessary operational expenses. Most small businesses operate on tight budgets during their initial years. They eventually close their door due to a lack of working capital. Entrepreneurs can improve the working capital position of small businesses by cutting down unnecessary operational expenses.

The biggest lessons that entrepreneurs learn from this book are:

- The bottom line is more important than the top line.

- Focus on cash flows and profits instead of scaling faster.

- Become profitable before making efforts to scale.

- Avoid survival trap (According to Mike, a survival trap is a situation where entrepreneurs end up living cheque-to-cheque).

Below provided are the four actionable steps that help entrepreneurs implement the Profit First Technique and convert the business from the cash eating monster to a profit-making machine:

- Split cash inflows into two accounts:Profit Account

Expenses Account. - Never use the money in the Profit Account for operational expenses. Keep it out of sight and make it hard to access.

- Do not access the Profit Account unless there is a compelling reason. When the available cash is lesser, you will be forced to spend less and find creative ways to achieve more with less.

- Check balances in regular intervals and manage payables and budget allocations accordingly.

The Richest Man in Babylon

The Richest Man in Babylon is one of the oldest books that offer financial advice through a collection of parables. Written and published by George Samuel Clason in 1926, this book provides financial advice grouped into themes such as "The Seven Cures for Lean Purse" and the "Five Laws of Gold.” However, advice offered in these themes overlaps sometimes.

Here is a brief overview of the seven cures for the lean purse:

The First Cure: Start thy purse to fattening

This cure advises on saving 10% of annual income to start building wealth. The systematic savings every month fattens your purse and builds a corpus.

The Second Cure: Control thy expenditures

Don’t confuse between luxuries and necessities. You can control your expenses when you draw a line between your needs and desires.

The Third Cure: Make thy gold multiply

Make investments in assets that generate income over a period. Make sure to compound the investment return from these assets. Income-generating assets can create a huge wealth in the long term.

The Fourth Cure: Guard thy treasures against loss

Don’t fall into the trap of get-rich-quick schemes. You need money to make more money. Therefore, always focus on protecting the principal through careful vetting of any investment.

The Fifth Cure: Make of thy dwelling a profitable investment

A roof on your top is always important. Ensure you purchase a house within your ability and use it to establish a business or generate additional income.

The Sixth Cure: Ensure a future income

Everybody has to undergo a phase called retirement. Therefore, you should create a retirement fund or pension that fulfills the needs of your family after you retire from active working life.

The Seventh Cure: Increase thy ability to earn

Never stop the process of developing and fine-tuning skillsets that increase your earning power.

The Five Laws of Gold also offer financial wisdom on similar lines to the Seven Cures. To implement the financial wisdom provided by The Richest Man in Babylon, you should do the following things:

- Pay yourself first (Develop your skillsets).

- Invest a portion of your income on revenue-generating assets.

- Invest in what you know for the long term.

- Have a home that not only shelters you but also generates income.

- Protect your money against losses.

- Create a retirement corpus that helps you protect yourself when you no longer have the ability to work.

The Lean Startup

In the book, The Lean Startup, Eric Ries put together valuable life lessons he learned while implementing lean manufacturing approaches that improve capital efficiency and leverage human creativity. This book emphasizes entrepreneurs testing scientific hypotheses with the minimum viable product (MVP) rather than creating elaborative business plans.

The five key takeaways from The Lean Startup are:

- The goal of a startup is to figure out the right thing to build (something for which customers are willing to pay).

- Customers don’t express what they want. It is the responsibility of entrepreneurs and businesses to drive what customer wants from their action or inaction.

- Entrepreneurs can build a successful business if they put MVPs through the Build-Measure-Learn feedback loop as quickly as possible.

This book provides a lot of practical tips that help people develop an entrepreneur mindset and build a business. It makes entrepreneurs answer the following questions when they are developing a product or building a business:

- Does my product provide value to customers?

- Should this product be built?

- Can we build a sustainable business around the product or service?

- How will customers recognize our service?

- Do customers recognize the problem our product is trying to solve? If yes, will they buy it? Will they buy from us?

The Millionaire Next Door: The Surprising Secrets of America's Wealthy

This book is a compilation of the research conducted by Thomas J. Stanley and William D. Danko. They analyzed the buying and saving behaviors of Under Accumulators of Wealth (UAW) and Prodigious Accumulators of Wealth (PAW) to offer personal finance wisdom to the people of America. UAW is a set of people who have low net wealth compared to their income. PAW is a set of people who have a net worth equal to one-tenth their age, multiplied by their annual income.

Better Than Theory vs. Better Off Theory

The authors of this book derived two theories to explain the behaviors of UAWs. The Better Than Theory states that the UAW's measure the level of their success through comparison to neighbors and end up spending more when their income rises. The Better Off Theory is highly relevant to the behavior of children of a poor family who land a high-earning job. These people tend to showcase that they are better off than their parents and spend huge money on acquiring depreciating assets such as a foreign luxury car, a large house, and a club membership.

To develop a millionaire mindset, you need to do the following things in your day-to-day life:

- Spend less than you earn. People who spend more than what they earn would fail to increase their net worth. Most UAWs spend more than they earn to keep up with neighbors.

- Don’t buy depreciating assets which often are regarded as status objects. The best example of a depreciating asset is luxury vehicles.

- Don’t spend tomorrow’s money today as it puts you in the debt trap.

- You should take the financial risk if it is worth the reward. Most PAWs invest money in revenue-generating assets.

The Intelligent Investor: The Definitive Book on Value Investing

Authored by Benjamin Graham, The Intelligent Investor provides a great deal of information on stock market investing. This book is considered the bible of stock market investing. The vital principle this book will teach about stock market investments is the Margin of Safety. According to Benjamin Graham, the margin of safety can be achieved by investing in undervalued stocks or out-of-favor stocks and diversifying portfolios by purchasing stocks with high dividend yields.

Benjamin states that the investors should not extrapolate previous stock prices while making investments. He suggests investors not to:

- Buy into the hype of bull markets.

- Listen to friends and relatives who may not be experts in the stock market.

- Invest in a company that they don’t understand.

- Sell stocks when there is a panic in the market.

While analyzing stocks, Benjamin wants investors to look into the following aspects:

- Industry’s as well as organization’s long-term growth prospects.

- The quality of the promoters and the company’s management.

- The historical and current dividend rate of the company.

- The historical and current debt levels of the company.

- Check if the Return on Capital Employed (ROCE) and Return on Equity (ROE) are consistent.

On a whole, this book helps you to make evidence-based investment decisions. It enables an individual to identify his or her financial goals and helps them to create a portfolio of stocks and index funds accordingly. Irrespective of whether you are a defensive investor or an enterprising investor, this books helps you develop a framework for selecting stocks and creating portfolios.

The bottom line

Overall, financial discipline plays a crucial role in an individual becoming successful in both personal and professional life. The five books summarized in this article offer numerous insights on personal finance that help in developing a financial discipline and building profit-generating assets or businesses. If you are an aspiring entrepreneur, you may love to read all these books, develop appropriate personal finance frameworks and achieve a millionaires’ mindset.