You've started as a freelancer. You now determine your own hourly rate, and which assignments you work on. According to the CBS, in 2003 8% of the working population worked as freelancers. By 2020, that figure is 13%. More and more professionals are starting out as freelancers and taking matters into their own hands.

In this new situation, you run into questions. Suddenly there is a whole lot of money coming in. How much can you pay yourself? What does the tax authority expect from you as a freelancer? In this article we explain how you can organize this smartly and automatically, so you don't spend money that is not really yours. This way you avoid getting into financial trouble and you know how much you can pay yourself.

How to organize your finances

As a freelancer, you need to keep your business records. Perhaps not the most enjoyable part of working for yourself, but fortunately you can do this in a simple and smart way. We'll help you get it right the first time, so you know exactly how much you can spend and how much is for the tax authorities.

Open a business account

With a Chamber of Commerce number, you can open a business bank account. Every well-known bank has business options for you as a freelancer. If you want to do your bookkeeping smartly, we recommend you to open a business account with a bank that allows you to work with different IBAN's, such as Knab or bunq.

A modern bank like that gives you the opportunity to open several payment and savings accounts with just one account. This way you can easily divide your money over different pots, or bank accounts. Think of: your tax account, your profit account, your expense account and your inbox account.

Use an online accounting tool

Keeping the accounts manually in Excel is a thing of the past, and you no longer keep the receipts in your old shoe box. Fortunately, it can be much easier with the online accounting tools that automatically process your administration, such as Moneybird, Snelstart and Jortt.

In these tools you can also simply create and send your invoices, which are immediately fully formatted according to the rules of the tax authorities. This way even your administration becomes a piece of cake. You put in the right data, send the invoice to your client and when it is paid, you see it immediately on your bank account and in your accounting tool.

Set your VAT aside as soon as your invoices are paid

Not all the money that comes into your account is actually yours. The money is in your account, but part of it is for the tax authorities. How do you avoid overspending and not having enough to pay VAT or income tax?

The VAT is paid quarterly by most freelancers. To be smart about this, immediately when the payment of your invoice comes in, set aside 21% in the VAT account. Do not touch it, and use it to pay your VAT every quarter.

Set aside your income tax

You also pay your income tax every year. To set aside your income tax, you can use a percentage for each paid invoice. This percentage depends on how much you earn.

Small entrepreneurs and starters can think of putting aside 30% of the income. Deposit the amount in a separate savings account and do not touch it until you have to pay the income tax. Do you end up paying less? Then you have already built up some nice savings!

Reserve for expenses

Do you have business expenses? It is good to take this into account and put the money aside. This way you are prepared for anything. Make an overview of your monthly (and annual) costs and make sure they are on the account when they need to be paid.

Reserve a savings buffer

See what you need for your work and build up a savings buffer for emergency situations. That way you always know you have a little extra for any possible expenses.

Automate

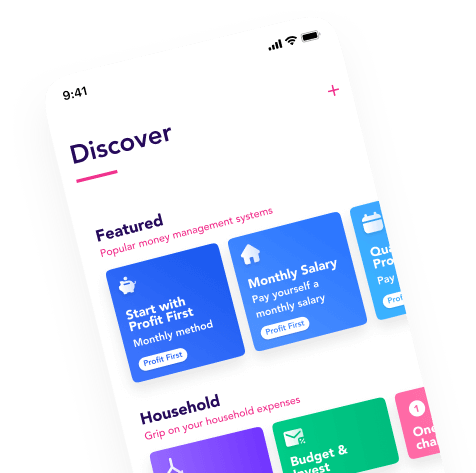

How can you ensure that your money is automatically divided among the various accounts, so that you don't have to? This will save you time, money and energy! You can do this easily in the Flow app. You download the app, link your bank accounts in one click, and set once how you want to arrange your banking.

Choose for example the following flow:

When an invoice is paid

Transfer 21% to VAT account Transfer 25% to income tax account Transfer 10% to expense account Fill up savings buffer to €1500 You now know exactly how much money you have to spend, and there are no financial surprises for you. Keep those freelance assignments coming!

The links in this article are affiliate links.