You're ready to add structure to your finances. Making a budget doesn't mean trying to spend as little as possible, and saving on everything.

You make a plan for your money, making sure you don't spend more money than comes in. That way, you can be sure you have money left at the end of every month, without any stress. A money plan helps you think about what you want to spend your money on. You can even have a jar with "free to spend" money, so you can spend that amount without feeling guilty about spending it.

And, a budget also means thinking about how much you want to save, invest and donate.

Step 1: Calculate your monthly income

The first step in creating a budget is to figure out how much money is coming in each month. In this step, you can also look at any extra income you receive each month. If you are a business owner, make sure you use your net income for this calculation. Set your taxes aside.

Step 2: Review your expenses

The best way to discover what you're spending is to look at your expenses over the past few months. By seeing what payments you made, you can get a good estimate of what you bought. This will give you insight into your current spending habits.

Step 3: Set your priorities

In this step, you examine what you consider important. You can reflect that in your budget. Think about how much you want to save and invest. This is your long-term plan. Think about how much you want to donate to the charities you like. And divide your expenses between jars so that every euro gets a purpose.

Do you like to go out for dinners? Make sure you have a money jar for your social needs. Do you prefer having enough money left to maintain your racing bike hobby? Make a jar for your sports. Or do you want to spoil your family during the holidays? Put money aside, so you have a good budget for the extras in December.

Step 4: Create your budget

Now the real work begins. You figure out how much money you want to set aside for the things you need, the things you love, and your savings. There are no rules, you can set it up however you like. But, it is of course crucial that you spend less than you earn.

Step 5: Evaluate and adjust

A budget is not fixed. You can always adjust your budget based on your needs and changing situations. Keep track of your budget and review it every 6 months to see if it is still a good match for your needs and the plan you have in mind.

This is how to keep track of your budget simply & automatically

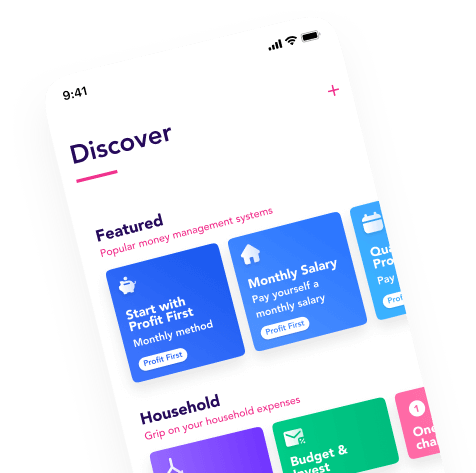

No one wants to spend a lot of time tracking their expenses. The Flow app is your friend. With simple rules, you automize where your money goes each month. This way you save automatically, and you know exactly how much money you can spend each month.

For example, this is what it looks like:

- When my salary comes in new, transfer the money left in my personal account to my retirement fund.

- For each incoming payment from a client, I want 21% of the amount to be transferred to my Tax account.

Manually managing your budget is no longer necessary – say hello to automatically dividing your income into jars! Easy does it.