At the end of your month, you should have a chunk of salary left. But maybe, like many people, you have a piece of the month left when your salary is already gone. And you longingly look forward to the day when your salary arrives again, hoping that you won't have to take too much out of your savings account in the meantime.

The real reason you don't have enough each month is (surprisingly) not your spending. Sure, your spending habits may have something to do with it. But why your money is disappearing each month is because you don't have a plan to allocate your money among money jars, like our grandparents did.

How did grandma do it so smartly?

Our grandparents divided their incoming money among important money jars, such as household money, clothing money, transportation, etc. That way they knew exactly how much they had left to spend, divided among the different categories. The household money was really for household purposes. And with clothing money, they bought clothes.

Now your salary goes to a bank account, and there it is waiting to be spent. You have no overview, and you don't know how much money you can still spend. You can go out for a nice dinner, or buy new clothes, and then find out that it will be tight to do the groceries that last week of the month.

You never learned to do this differently.

How can this be done differently?

You can achieve total control and insight into your money by creating a budget. See here how to create a monthly budget in 5 simple steps. That way you always know where you stand, how much money you have, and you don't spend too much on clothes, at the expense of your household money.

Less money coming in? No problem! Now you're prepared.

New changes, like a move, a baby on the way or a new job? Your budget changes with you.

Before you know it, you're no longer living from paycheck to paycheck, but looking confidently at your finances and the future.

Even better: it can even be done automatically!

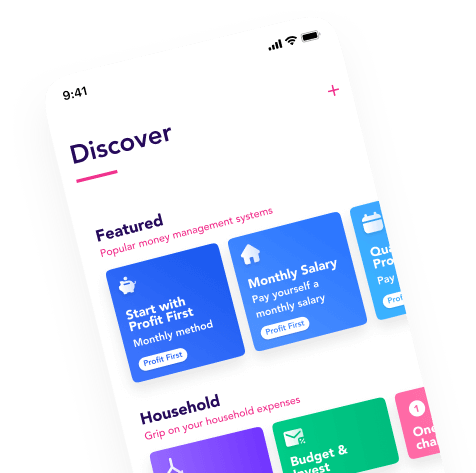

For your optimal money management, the Flow app is your friend. Flow allows you to set smart rules. So, you only have to think out your budget once, and from there, Flow takes over.

Consider these handy rules:

When my paycheck comes in, transfer the money left in the account to my retirement fund. For each incoming payment, transfer 21% to my Taxes bank account. When my salary arrives, transfer €100 for clothing money. Say goodbye to managing your money manually. Distribute your money automatically and smartly among pots, fully prepared for the new month.