For many people, every month it's a surprise what they can spend, and what they save. We're used to living like this, but it does bring stress. How am I going to pay the municipal taxes this month? I'd like a new car, what do I actually have to spend within my limits? Oh, paying the deductible for health care will be a big burden this month!

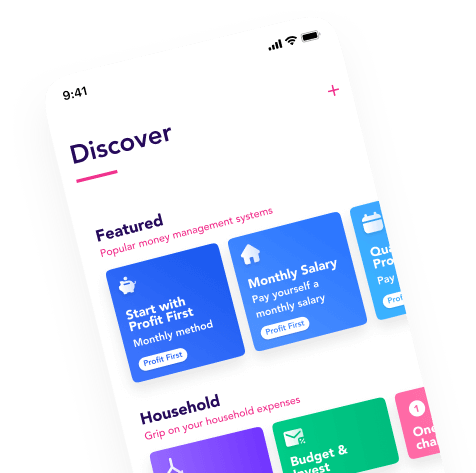

It would be more relaxing and profitable if your expenses and investments were fixed each month: a fixed amount, or a fixed percentage of your income. You can easily set this up. The nice thing is that you can automate your personal system of spending and saving. Many bank apps already support this in some form. The Flow app goes much further: now you can even do this across multiple banks and bank accounts. You divide your money in jars, and the app does the rest.

These are the 3 reasons to divide your expenses into jars and to automate them:

1. You save time. Transferring money between accounts, searching for accounts, paying bills - it takes your precious time, and you also have to "do it".

2. You save more. When you save X amount or X percentage automatically, it's completely automatic - you don't have to make an effort to save. It requires no action on your part. You no longer work from the premise of "save what's left", but you work from the premise of "spend what's left".

3. You simplify your life. You have less stress about your money flows, because you have fewer decisions to make. And you have an overview of how much money you can still spend each month. In short, you can be confident that your finances are in order. What about you (and your family)? Are you still manually working on your spending and saving, or do you automate this in a smart way?

Our (Flow) mission is to simplify your personal finance, by smartly automating all your spending and saving. So you don't have spend your time and stress on it.