We don’t want to make stupid money mistakes. That’s why we study freelancers who are professionals in money management.

As freelancers, we are continuously looking for tips and hacks from other successful freelancers.

Because why should we make stupid (money) mistakes, if we can learn how others have already ‘bypassed’ those mistakes in a successful way? That would be like designing your own Crossfit training regimen from scratch, while there are 1000s of workouts online, that have been tried and tested by top athletes worldwide. Such a waste of time and - of course - money!

But if we wanted to learn how successful freelancers manage their money, of course we must first decide what ‘successful money management’ actually means.

For us, this is plain and simple. Successful freelancers are the freelancers who:

- Have a stable, high-end income that allows them to live worry-free.

- Have a system in place, with ‘fixed’ money flows. For instance: 10% of their income goes to an Index Fund, 5% is reserved for unexpected surprises, etc., etc.

- Are happy and in control.

(The last point is not directly measurable. But we took it by face-value during our interviews.)

So what do financially successful freelancers do differently?

What distinguishes financially successful freelancers from the rest?

After interviewing 25 financially successful freelancers, we have extracted five money rules they live by. These rules really differ in topic; they range from mindset-rules, to behavior-rules, to moneyflow-rules.

Before we describe the five rules, let us note that these rules are in random order. So it’s not a step-by-step system. On another note, some rules may already resonate with you - and maybe you are already using some rules on a daily/monthly basis (great!). We have written these rules for ourselves, because we have greatly benefited from them. And we hope you will too. And if you would like to add your two cents to these five rules, please feel free to drop us a line at [email protected].

So, let’s get started.

Rule #1: Smart Freelancers eliminate debt aggressively.

The freelancers we’ve studied and interviewed all have in common that they save aggressively, so they can eliminate debt as soon as they can. But most freelancers we’ve studied didn’t borrow money for anything; they first saved and then bought/invested. Maybe with one exception: taking up a mortgage to buy a home. But then again, whenever they had more money to spend (for example, when their hourly rate increased), they use this money for extra down payments on their mortgage.

*How do YOU live by this rule? Do you still have debt, besides your mortgage? Do you have a fixed (automated) habit of paying off debt?

Rule #2: Smart Freelancers have an allocation system for their income across various "buckets", with a different bank account for each bucket.

Successful freelancers have different bank accounts - and every bank account has ONE purpose. But that’s not all. They also automate these allocations. So for instance, one freelancer we interviewed, has the following allocation system:

- Fixed cost (mortgage, insurances, car, etc.) 65%

- Holiday 5%

- Pension fund / savings 10%

- Health 2,5%

- Appearances (clothing, hairdresser, etc.) 10%

- Buffer 2,5%

- Guilt-free spending 5%

It bears to repeat; when these freelancers have more income to spend, they do not first increase their fixed cost or their guilt-free spending. They FIRST increase their pension fund / savings account allocations (see rule #3).

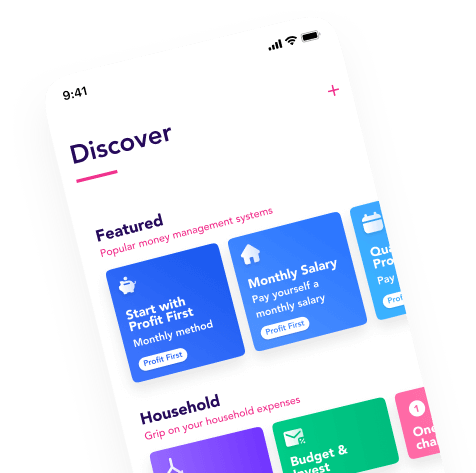

*How do you live by this rule? Is your money allocated and spread through different bank accounts? For us at Flow, this money rule is the main job-to-be-done for our app. Heck, it’s why we build it!

Rule #3: Smart Freelancers maintain the same spending behavior and - habits, no matter their increased income level.

This is a BIG one. This rule distinguishes the smart wealthy people, from the not-so-smart wealthy people (with Warren Buffet as the world’s best example of smart-wealthy; he lives in the same home for 40 years now. This house is worth under 1 million dollars. Which is strange, for a man worth over one billion dollars).

The freelancers we’ve interviewed are like Warren Buffet. That is, they’re all aware of the (sometimes exact) income they need to:

- do everything they need, plus

- a bit of what they want.

We say a bit here, because these freelancers don’t spend extravagantly on their wants, but they do spend more than average on what they need.

It’s very tempting to go out and eat at a fancy, expensive restaurant every week when your income increases with 15%. However, when you do this, your extra income doesn’t really have a function, or a job. The only job / function this money has, is to make you happy in the short term. Smart freelancers (the ones we interviewed) use this extra income not to splurge on restaurants. They use it for either essential things they need but lack, or on saving extra money for future purposes.

*What amount of money does your family need to have everything they need? Does this number increase when you make more money? If so, why?

Rule #4: Smart Freelancers know EXACTLY what they want to spend a lot of money on, and what they want to spend little or no money on. And they strictly adhere to this.

This is a direct follow-up for rule #3. Financially successful freelancers know what makes them happy, and they invest in that. And on the same note; they do NOT save money on small expenditures, when this is something they value. For example, one freelancer is a coffee-lover in its purest form. So for him, it was a no-brainer to buy an expensive (€2000) espresso machine. In his own words: ‘The cost of starting every day with an ‘okay’ cup of coffee, would make me sad. And starting your workday with a negative emotion about something you love (coffee), cost a lot more for me than this beautiful espresso machine. And by the way; I would blame myself daily for being too cheap to buy a decent espresso machine, whilst knowing how happy a great cup of coffee would make me every morning.’

Translated freely, is his advice:

- know what you value, and spend extravagantly on this.

- know what you don’t value, and save extravagantly on this.

*Does your spending behavior follow what you value most in life? What are the things that make you truly happy every day/week/month, but you save money on? What if you would change this?

Rule #5: Smart Freelancers have a bank account with a ‘guilt-free’ budget, from which they spend without feeling guilty on things they love ("guilt-free spending" - credits to Ramit Sethi).

As a follow-up for rule #4; financially successful freelancers ALWAYS have enough money in their bank account for things they value most. Personal finance guru Ramit Sethi calls this guilt-free budgeting. We believe this term captures the essence of what may be our deepest desire, when it comes to money: spending it guilt-free.

The key to creating a guilt-free spending budget? First, know what you value most (hint: it stresses you out when you don’t have enough money to buy these things). Start with things that creates daily happiness/value, then weekly happiness/value, etc. Until you end with a yearly event that makes you happy - for example, your yearly holiday.

Then, decide what your minimum required budget is, and multiply this with 1,3. Why? Because the key ingredient for creating a guilt-free budget is: creating MARGIN.

The third and fourth step is to automate your budget allocation and to start today. Do you need guilt-free money in december, so you can spend a lot for holiday gifts? Then start this month.

*When you think about ‘not having enough money’, what exactly do you think about NOT being able to buy / spend money on? How can you create a guilt-free budget for this?

Rule #6: Smart Freelancers are frugal but not cheap - because they know that the real difference is made by a higher income (and not by cutting back on a Starbucks coffee).

Everybody knows there is a thin fine line between being frugal vs being cheap. Don’t get me wrong - being frugal has its benefits, of course. For example, frugal freelancers don’t overspend on things they don’t need (which is a great competence).

However, before you know it, being frugal becomes a habit. It becomes a goal on its own. And ultimately, this will create a scarcity mindset.

Financially successful freelancers live and act with an abundance mindset. And this means they focus more on creating money then on saving money. Because they know that in the long run, your best bet on becoming financially independent is on improving your money-making-machine.

One way they do this, is by continually building money-making assets. These assets can be key skills with timeless value - for example, sales skills. Or it can be assets that directly increases your monthly income. Of course, this topic is too broad for us to elaborate in this article, but let us end with this tip: when you focus on making more money, your best bet is to combine timeless skills with timeless market problems. This creates a great financial safety net. Becoming the best in solving a problem that will exist for the next decades, is always a good idea.

Let’s summarize!

Financially successful freelancers:

- Eliminate debt aggressively

- Have an allocation system for their income across various "buckets", with a different bank account for each bucket.

- Maintain their spending behavior and - habits, no matter their increased income level.

- Know EXACTLY what they want to spend a lot of money on, and what they want to spend little or no money on. And they strictly adhere to this.

- Have a bank account with a ‘guilt-free’ budget, from which they spend without feeling guilty on things they love.

- Are frugal but not cheap - because they know that the real difference is made by a higher income.

How do you score on these habits?

Do you recognize yourself in them or not?

Thanks for reading this article, we really appreciate it. If you have any thoughts/questions/compliments, feel free to comment. And don’t forget to follow us on LinkedIn.