Bunq works very well with Flow. The connection is excellent, and you take full advantage of the possibilities within the Flow app to manage your money well and insightfully, on autopilot. With Flow, you distribute your money smartly over the 25 subaccounts that bunq offers. Let money flow according to your spending plan, achieve your savings goals and invest in your future.

Flow + bunq = ❤️

Bunq has several subscriptions, fit for any need. All of them are compatible with Flow, but the more expensive ones offer 25 subaccounts, which comes in handy for money automation. The plans for ultimate money management are Easy Money and Easy Green. With Flow, you give your bunq account superpowers.

✔ A separate account or savings jar for each budget

✔ Automatic distribution of money to your accounts and budgets with smart rules

✔ Automatic saving

✔ Real-time connection with the Flow app

✔ Peace of mind about money

✔ Advanced actions like: fill buffers up to a certain amount, automatically sweep buffers empty at the end of the month, and choose what to do with money that’s left after filling your accounts according to your rules, also known as the ‘from what’s left’ action

✔ Advanced triggers like: activate your monthly spending plan as soon as your money comes in. This could be your salary, tax supplements or when an invoice gets paid.

1 bank account 💶 = 1 jar 🍯

Flow uses different bank accounts to set up rules and automatically move money for you. For example, you might have one bank account for your fixed costs, one for holiday savings and one for groceries. With the 25 subaccounts bunq offers, you will have more than enough to arrange your spending plan according to your wishes.

Those accounts don’t even have to be at the same bank. You can also connect other bank accounts in Flow. The power of Flow is being bank-agnostic and bridging the gap between all your accounts, so you have the option to also connect bank accounts from other banks.

And with Flow, you can build your own money automation system with your bunq accounts and other bank accounts.

Get started with Flow + bunq

Ready to start flowing money from your bunq account? Here’s what you need to do:

1️⃣. Download the Flow app

2️⃣. Connect bunq accounts

3️⃣. Set up your first Flow

4️⃣. Let your money grow

Why you need Flow on top of your bunq business account

Let us give you an example!

When an invoice payment comes in:

- Put 21% on VAT buffer

Of what is left you put:

- 50% on salary account

- 1% on profit account

- 30% on income tax buffer

- Top up your business expense account to € 2000

- Send up to €300 to your savings buffer

And of what is left - send 100% to investments

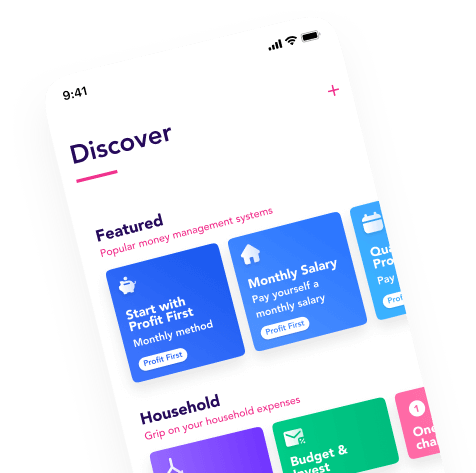

- Profit First: automatically divide your money when invoices are paid, according to the proven principles from Profit First.

- AOV Buffer: set aside the incoming money for taxes, your income, fixed costs and a buffer for the future.

- VAT Buffer Flow: automatically Flow 21% VAT to your second account when your invoice payment arrives.

Why you need Flow on top of your bunq personal account

Let us give you an example!

- Fill your groceries account up to €500 automatically each month

From the remainder of your salary, you divide:

- 10% to pocket money

- Top up your car buffer account to €1500

- Send up to €300 to your savings buffer

And from what's left - send 50% to savings & 50% to investing.

It gets better. Do you have pocket money left at the end of the month? Send 100% to savings. This way you start fresh each month.

- 5 Jars Method: Five jars (bank accounts) to divide your money according to your spending plan: Fixed costs, Giving, Rainy Day, Investing and Spending. We got you covered!

- Salary Hopper: Do you have a different bank where your salary comes in? Hop your salary to your bunq account with the Salary Hopper! Keep your other bank account for your fixed expenses & send the rest of your money to bunq.

- Budget & Invest: Save money for the future, invest while keeping your monthly budgets and emergency buffer filled.

FAQs

❓ What does manual and auto-approving flow mean?

Flow = money automation. That means you set up conditions (ex: when I receive my salary) and actions (send 10% to my holiday savings account). These conditions ****can happen automatically in the background each month, without you needing to press any button. However, we know that sometimes you want a bit more control over where your money flows, so you also have the option to manually approve Flows. In this case, you’ll get a notification and be asked to approve the transaction before your money flows anywhere.

❓ Can I use Flow for both business and personal?

Yes. As long as the bank is supported, you can add as many business and/or personal bank accounts as you want. We think having all your finances in the same place is a big advantage of Flow, so we encourage you to add and organise everything in the Flow app.

Get started with Flow + bunq

Ready to start flowing money from your bunq account? Here’s what you need to do:

1️⃣. Download the Flow app

2️⃣. Connect bunq account

3️⃣. Set up your first Flow

4️⃣. Let your money grow