With the rising energy prices and expensive groceries, you may, more than ever, feel the need to get a handle on your spending and have an overview of your finances. This year, you want to know where you stand and be able to make adjustments where necessary. That’s why we’re giving the webinar Your money matters in order (in Dutch) on Monday, January 16th at 8 p.m. We'll tell you in simple steps how to put your own money matters into a good, solid plan.

Because how do you even know if you really have money for new running shoes? And how do you know how much those lattes actually cost you? How much are you really spending on home delivery and drinks?

Often it's more than you think. Should you then go on some kind of money diet? Because at the same time, of course, you want to enjoy yourself now; after all, you work hard enough for it.

You need:

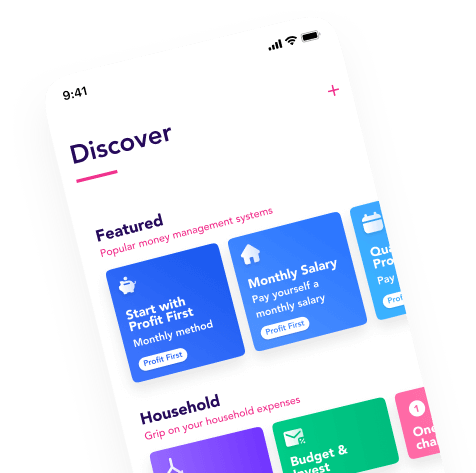

Oversight, so you can instantly see, at any time of the month, how much spending money you still have.

Monthly spending money for your life here and now.

Building up a savings buffer that you really only use for emergencies.

Consistently meeting your savings goals, without taking money out of your account in between because you have to pay municipal taxes.

Building up future money, for your retirement or by investing - even if you don't understand stock markets or don't feel like spending a lot of time on them.

Real change

In the webinar (NL), we will tell you how to get your finances back on track. Having good intentions is of course, step one. But good resolutions fade quickly. Is 2023 the year you really want to see a change? Then create a practical money plan so you know exactly what it can look like in the near future.

Flow Founder Daan van Klinken explains how to get those basics in order, always understanding where you stand, financially. That way you can easily adjust, and you know exactly how much money you still have to spend. That gives insight and peace of mind.

Hendrik Meesman, managing director of Meesman Index Investing, gives you the info you need for a clear plan for your future money. He shares how to invest smartly, without following the stock market closely, or spending a lot of time doing so. You don't even have to know much about investing. Hendrik shares the basics so you know what you can do.

Is it time to turn your good intentions into a practical money plan?