Flow has raised 3.5 million euros during an international seed investment round. With this investment, Flow can scale up its platform, which makes it possible to automatically distribute incoming and outgoing money flows, taking the step towards self-driving money: smart, fully autonomous money management. Flow now also can expedite European expansion plans as it sets out to become the largest player in this fast-growth market.

The investment round, led by Eleven Ventures, involved several investors from the financial sector. The round was joined by RockSalt, the venture arm of SaltPay, as well as Silverflow co-founder Robert Kraal (former COO Adyen), Hristo Borisov (founder and CEO of Payhawk), Marnix van der Ploeg (Booking.com) and Travel Health Group’s owner Arnoud Aalbersberg.

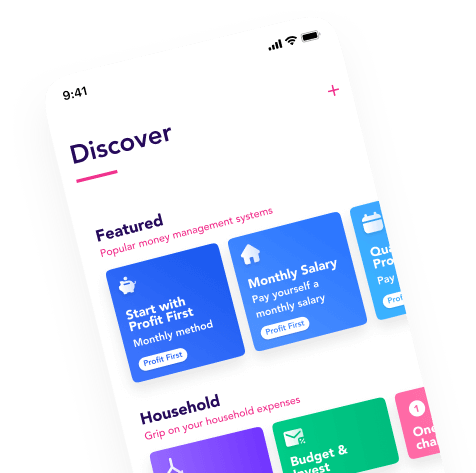

The money management app offers solutions to freelancers and the self-employed. In addition to irregular income and the need to reserve money each year to pay VAT, insurance, pension and income tax, entrepreneurs often lack the time and overview to manage their financial future properly. In addition to freelancers, consumers, who are not always able to muster the necessary financial discipline, also benefit from a money system that takes all the worries out of their hands.

Flow contributes to achieving their financial goals, whether that is schooling expenses, home ownership, or a rainy day holiday fund, they rest safe in the knowledge that their money is working for them and their needs, without having to crunch the numbers on a daily basis.

Ambitions in artificial intelligence

“We are very happy with the awarded capital and the expertise of this group of investors. The existing investors have also shown that they continue to believe in Flow Your Money”, says founder and Co-CEO Daan van Klinken. Besides capital to scale up our platform and to develop artificial intelligence for that purpose, this investment round brings a wealth of relevant knowledge. This will help us realise our ambitions to become the leading self-driving money player, not only in the Netherlands, but ultimately across Europe.

“All the more people are choosing freelancing as a long-term career path. However, this market segment lacks suitable finance products and services, which often leaves gig-workers and freelancers out of the financial mainstream. Flow is on its way to revolutionize the orchestration of both personal and business finance management, leveraging cutting-edge technology and AI. We are very happy to welcome the founders to the Eleven family and further support their journey.” says Vassil Terziev, Managing Partner at Eleven Ventures

All money destinations on one platform

Flow has had a PSD2 Open Banking license since 2020, allowing it to view and initiate financial transactions. With this, the fintech was one of the first Open Banking companies to receive both an AIS and PIS PSD2 license from the Dutch Central Bank, making it possible to connect all European banks.

Besides newer Dutch banks, such as bunq and Knab, major players like ING, Rabobank and ABN AMRO are already connected to Flow. Other European banks are following suit quickly, and the ultimate aim is to make the app available to all relevant European banks. In addition to banks, Flow is connecting various important money destinations to its platform; think about investing, crypto and charities. This will create an ecosystem for money management in which users of the app can be completely unburdened.