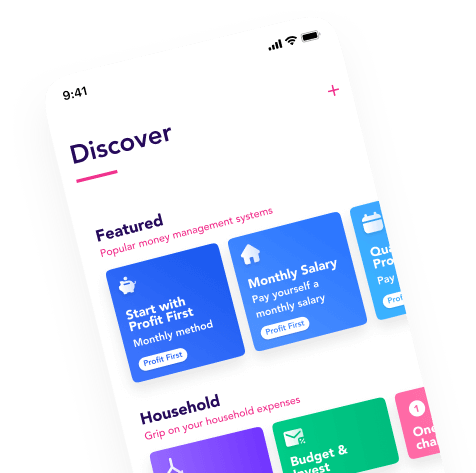

Would you like to use the Flow app, but your bank is not working optimally in the Flow app? We've come up with a solution for that! In this article, you'll read about the Salary Hopper, how it works and how you can stay with your current bank while enjoying the benefits of a modern bank that works seamlessly with the Flow app.

So, you can still smartly automate your finances, and organize them the way you want.

Why are you stuck with your bank, anyway? Some people have a mortgage with a bank and are therefore required to also have a bank account there. Or maybe you've had this bank account for a long time, and you don't feel like passing on your new bank details everywhere. Whatever the reason, we get it. We have the solution.

Why a ‘jar’ bank?

Some banks make paying, saving and budgeting so incredibly easy. Automize with Flow, and your banking will be in order forever. That way, you don't have to worry about it and can spend your energy on more fun things!

What's a 'jar' bank, you might wonder? A jar bank gives you the opportunity to open several bank accounts and savings accounts within one account. This way you can divide different saving jars over real bank accounts. For example, think of a vacation account: this is where you deposit a monthly vacation contribution. When you are on vacation, you take that debit card and can pay directly from the account.

Or perhaps an everyday example: your grocery money. Deposit your grocery money in a special account and pay for your groceries from that account. That way, you know exactly how much money you have left for your groceries. And you will never end up buying that cool coat and therefore have no grocery money left at the end of the month (which means you have to take some money out of the savings account after all).

This is not the same as the savings jars offered by most major banks. You can save in these, but if you want to use the money, you have to manually transfer it each time. You only have one checking account, and you pay from there. This is nice for a while, but it quickly becomes a hassle.

What modern 'jar' banks are there?

Currently, the best way to do this is with modern banks like bunq and Knab. Both have a clear, well-organized app and many additional features. This way you have full insight into your finances, and you can automate your money matters.

These banks were open to setting up a great connection with Flow, so you can really get the most out of your money. In other words, with Flow, your bank account gets superpowers!

The Salary Hopper

Hop your salary from your old bank to your new bank, hassle-free! Review what you want to pay from your old bank account (fixed expenses, mortgage) and set it up to automatically transfer the rest of your salary to your new bank account from bunq or Knab. This happens then:

When your salary arrives:

- Transfer €1100 to the bunq/Knab inbox.

From that account, you can set up new flows to distribute that money the way you want. For example:

When the salary hopper comes in to your new account:

- Transfer €500 to grocery account

- Transfer 10% to a pocket money account

- Transfer 10% to Meesman Index Investing

- Top up savings account to €5000

- From what's left: deposit into vacation account

What do you need for the Salary Hopper?

To hop your salary you need:

- Your old bank account

- Your new bank account with Knab or bunq

- Your Flow account & the two linked bank accounts (you set this up in a minute).

Download the Flow app here.

The links in this blog are affiliate links.