The Dutch like to save, and we are good at it. Yes, really, we are savings champions compared to other European countries. But how much does the average Dutch person actually save, and how do you 'score' compared to the average? Maybe the numbers will help you find just a little extra motivation to work out your savings strategy. We looked up the figures for you.

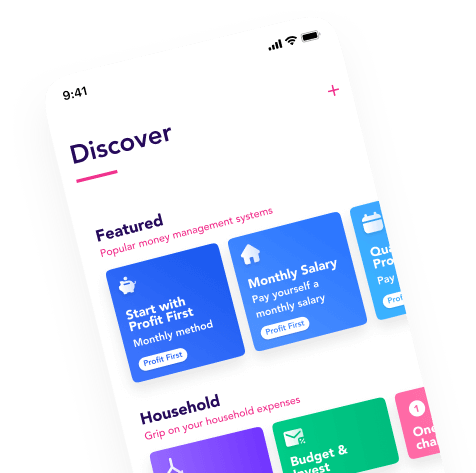

Saving can be quite difficult in practice, but it doesn't have to be. There are various ways of saving that make it harder to really save. For example, when you wait until the end of the month, with the idea of transferring all the money you have left to your savings account. And then it turns out you always run out of money. Or you automatically transfer an amount per month, but you have no plan for the rest of your finances. As a result, you sometimes spend too much – oops – and you take something from the savings account to get to the end of the month. This is very normal – and there is good news. You can do better.

How many savings does the average Dutch person have?

According to CBS, a household has an average of €42,300 in its savings account. That sounds like a lot, and it is. The average picture is distorted by the wealthy households that greatly raise the average. In this case, it is also interesting to know how many savings is the middle (median) among Dutch households: €14,900. This means that half of Dutch households have more savings, and the other half have less.

Total amount of savings broken down by age

Of course, the amount of savings a household has also varies by age. The older you are, the longer you save.

Up to 25 years of age

Average: €8,100

Median: €2,700

25-35 years old

Average: €16,200

Median: €6,700

35-45 years old

Average: €26,600

Median: €10,900

Age 45-55

Average: €42,400

Median: €16,300

Age 55-65

Average: €55,200

Median: €21,000

Age 65-75

Average: €61,000

Median: €24,500

Age 75-85

Average: €60,500

Median: €25,000

85 years and older

Average: €63,000

Median: €25,400

Create a savings plan for your savings buffer and more

It's fun to compare, and at the same time it matters little what others do. What matters is that you have everything you need to set up a good savings plan. This way you can cope with financial setbacks and have a grip on your finances.

Does your savings plan never work out? Making a good plan helps you to successfully set money aside. We've outlined the three simple steps for you, so you can start with your solid plan today!