You know what you earn and have figured out what budget you should be able to live on each month. The start is there, and you feel satisfied with your money plan. Yet, it never quite works out. You never actually stick to your budget, and at the end of the month it's always a surprise whether and how much money you have left over. How can that be? Probably because of one of these 7 reasons:

1. You don't have a plan or you don't have a specific goal. You just do whatever. You don't keep track of your expenses, you don't have your income in focus, and you don't know what expenses to expect. You have a budget, but you have no idea how your budget fits what you're actually doing. By tracking income and expenses, you get a better and closer understanding of your money habits. That way, you can create a budget that fits.

2. You don't budget all your income. That's too free and difficult to manage. What usually happens to undistributed money? You spend it. Instead: give every euro a purpose. Take a good look at your income and make sure every euro is distributed in your budget. You can divide it into: expenses, savings goals or investments.

3. Your budget is way too ambitious. You don't take into account what you actually spend, but think about how you want it to be at a perfect time. This can be a good end goal to work toward. When you start budgeting, it's better to start with where you are now. Suppose you spend €1000 on groceries and you would like to spend less money. Then you set your budget at €1000 and after two months you can see how it goes, and possibly lower your budget to €900. From that position you can continue to adjust and adapt budgets step by step.

4. You make budgeting boring, difficult or time-consuming. Exceptions aside, nobody likes to spend hours processing and categorising receipts. And having to think about it every time. Then it really becomes an obstacle, which you prefer to walk around with a wide circle.

5. You don't automate. The more you have to do manually, the more likely you are to drop out. Automate as much as you can. That way you only have to think it out once, and then automation takes over. This is where we have to admit our subjectiveness: at Flow, we think this one is very important and we know that this is a major turning point in your money management and budgeting.

6. You lack overview and insight (because you manage all your money in one bank account, for example). Sometimes it seems like you still have quite a bit of money, which you then spend on impulsive purchases and nice shoes. At the end of the month it turns out that it is not quite right and you may even have to take some out of your savings account. Oops!

7. You need more money. A small budget doesn't have much wiggle room. Saving only gets you so far, but it's not always enough. Maybe it's within your power to earn more, ask for a pay raise or switch jobs.

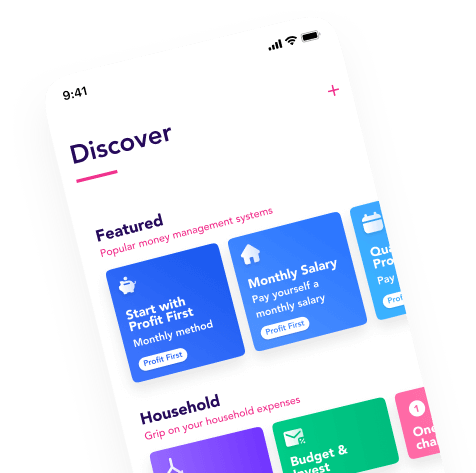

Do you recognize this? Fortunately, we have the solution! Flow makes budgeting easy, clear and realistic. You set clear goals, can create jars for all your expenses and make sure your budget actually fits your lifestyle. Download Flow now!